NOTICE REGARDING WATERFORD UNION HIGH SCHOOL AND WATERFORD GRADED SCHOOL TAXES

This is written to advise you of a misrepresentation of the percentage of increase or decrease shown in the 2013 to 2014 Waterford Union High School and Waterford Graded School tax amounts shown on Village of Rochester property tax bills.

Each year the village, as well as other municipalities in the state, receives a State School Property Tax Credit which is applied to offset the full tax levy of K‐12 school districts. This is applied directly against the total amount of taxes due on each property tax bill.

Racine County implemented a new software program this year to generate 2014 property tax bills.

In the previous software program utilized by Racine County, the State School Property Tax Credit was allocated to offset Waterford Union High School taxes only, and none was allocated to offset Waterford Graded School taxes. This was because the software program only allowed the credit to be applied to one school district (most school districts are one K‐12 district vs. two separate K‐8 and 9‐12 districts).

Previously, the amount shown as your Waterford Union High School tax was reduced by the full school property tax credit; and the amount shown as your Waterford Graded School tax was not reduced by the school property tax credit.

The new software program allows the School Property Tax Credit to be allocated correctly to both districts. Other factors may affect this, but if your assessment stayed the same from 2013 to 2014 your Waterford Union High School tax amount shows a percentage increase of +46.7%; and your Waterford Graded School tax amount shows a percentage decrease of ‐15.8%. Although the total amount of taxes being collected is correct, the percentages of increase/ decrease shown for the school district taxes are incorrect.

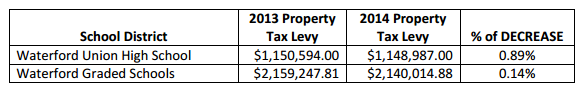

These are the total amounts and percentage decreases of school district property taxes that were charged over the Village based on its total equalized value and then apportioned over the equalized (or fair market value amount) shown on each individual property tax bill:

The amounts and percentages will be reflected correctly on all future property tax bills. This is a one year glitch due to the change in property tax software. Be assured the total amount of property taxes being collected, both on each individual property tax bill, and from the Village as a whole are correct.

Sincerely,

Betty J. Novy, MMC CMTW WCPC

Clerk‐Treasurer

Village of Rochester